Mukuru achieves multi-national

roll-out success and savings with Fraxion

Mukuru

![]() Industry: Fintech

Industry: Fintech![]() Headquarters: South Africa

Headquarters: South Africa![]() Employees: 125

Employees: 125

![]()

About Mukuru

Mukuru is one of Africa's largest money transfer providers and a leading next-generation financial services platform. They serve the emerging consumer market across twenty-five countries, providing safe, convenient, affordable...

About Mukuru

Mukuru is one of Africa's largest money transfer providers and a leading next-generation financial services platform. They serve the emerging consumer market across twenty-five countries, providing safe, convenient, affordable...

About Mukuru

Mukuru is one of Africa's largest money transfer providers and a leading next-generation financial services platform. They serve the emerging consumer market across twenty-five countries, providing safe, convenient, affordable international money transfers through various platforms, including WhatsApp, USSD, the Mukuru App, and their website. Mukuru enables financial inclusion through technology solutions and a range of financial services products to meet their customers’ everyday needs.

As a leading fintech provider, Mukuru is dedicated to constructing a robust financial payments infrastructure throughout Africa, seamlessly integrating physical and digital channels. Their commitment lies in unlocking new value-added services for their customers. Customer connection in multiple languages is evident in their Contact Centre, conversing fluently in fifteen languages, showcasing a commitment to serving diverse markets and needs.

Before Fraxion

As Mukuru expanded its operations, managing the intricate web of finance and procurement across multiple countries became increasingly complex. Each country had its unique set of rules and regulations, making it challenging to find a solution that could adapt to their diverse needs. The team needed a robust procurement solution that could deliver mobility, flexibility, and complex business rules support. Identifying an accessible solution capable of supporting a team working in remote locations with extensive travel requirements, and internet connectivity challenges was a fundamental prerequisite.

Mukuru struggled with:

- Complex financial and procurement management: As the company expanded, managing finance and procurement across multiple countries with different rules and regulations became increasingly complex.

- Manual inefficiencies: Manual processes were inefficient for remote work and frequent travel requirements to areas with limited internet connectivity.

- Lack of control: Requisition to purchase order processes were disconnected, causing inefficiencies and difficulties in managing spending across countries and currencies, which impacted financial control and decision-making.

- AP delays and overpayment: Manual, email-based invoice approval system led to late approvals, duplicate payments, and reputational risks due to delayed payments. The process was inefficient, requiring bookkeepers to upload thousands of invoices across multiple systems for approval, which was not scalable or effective for managing the complexities of a multinational organization.

- Inadequate reporting capabilities: ERP system was unable to handle the high volume and complexity of transactions across twenty-five countries, limiting their reporting capabilities.

- Slow expense reimbursement: Staff had to pre-fund trips and submit expense requests via email, leading to multiple manual invoice payments and delayed reimbursements. This created inefficiencies and administrative challenges.

- Financial risks: Risks and complexities in managing cash-based transactions in countries with cash-driven business models.

- Lack of control and overspending on travel: Uncontrolled travel bookings and high travel costs due to a decentralized process. Employees were booking travel without proper oversight, resulting in unnecessary and excessive spending.

With Fraxion, Mukuru has gained:

- A successful deployment in their South African entity, which led to an expanded rollout to their largest entity, Zimbabwe. Following this success, the company implemented Fraxion across all 25 countries.

- A streamlined procurement process, connecting requisitions, purchase orders, invoices, and approvals. It introduced decentralized approvals, allowing managers to set spending limits by country and currency and gain financial control.

-

The mobile app enables easy approvals and expense claims, ideal for a team with frequent travel and remote work, with accessibility even in areas of low connectivity.

-

A simplified invoice management process that allows requesters to upload invoices directly into the system for approval. This streamlined workflow has improved efficiency and control across the organization.

-

Enhanced reporting and the introduction of advanced features like supplier diversity reporting and real-time transaction tracking.

-

Automated expense management streamlines processes, reducing manual tasks and speeding up reimbursements. Bookkeepers can now generate CSV reports with banking details, which are efficiently processed for payment.

-

Over 50% reduction in travel expenditure via pre-approval processes and booking oversight. This strategic approach enhanced control over travel costs and optimized spending across the organization.

-

Cash advance functionality has enabled pre-approval of spending and reconciliation of cash with receipts post-trip. This approach has significantly reduced risk.

-

Risk management and control functions have been key in ensuring accuracy, preventing discrepancies, and supporting successful audits with PwC.

-

Improved collaboration between teams.

The features driving efficiency and savings for Mukuru

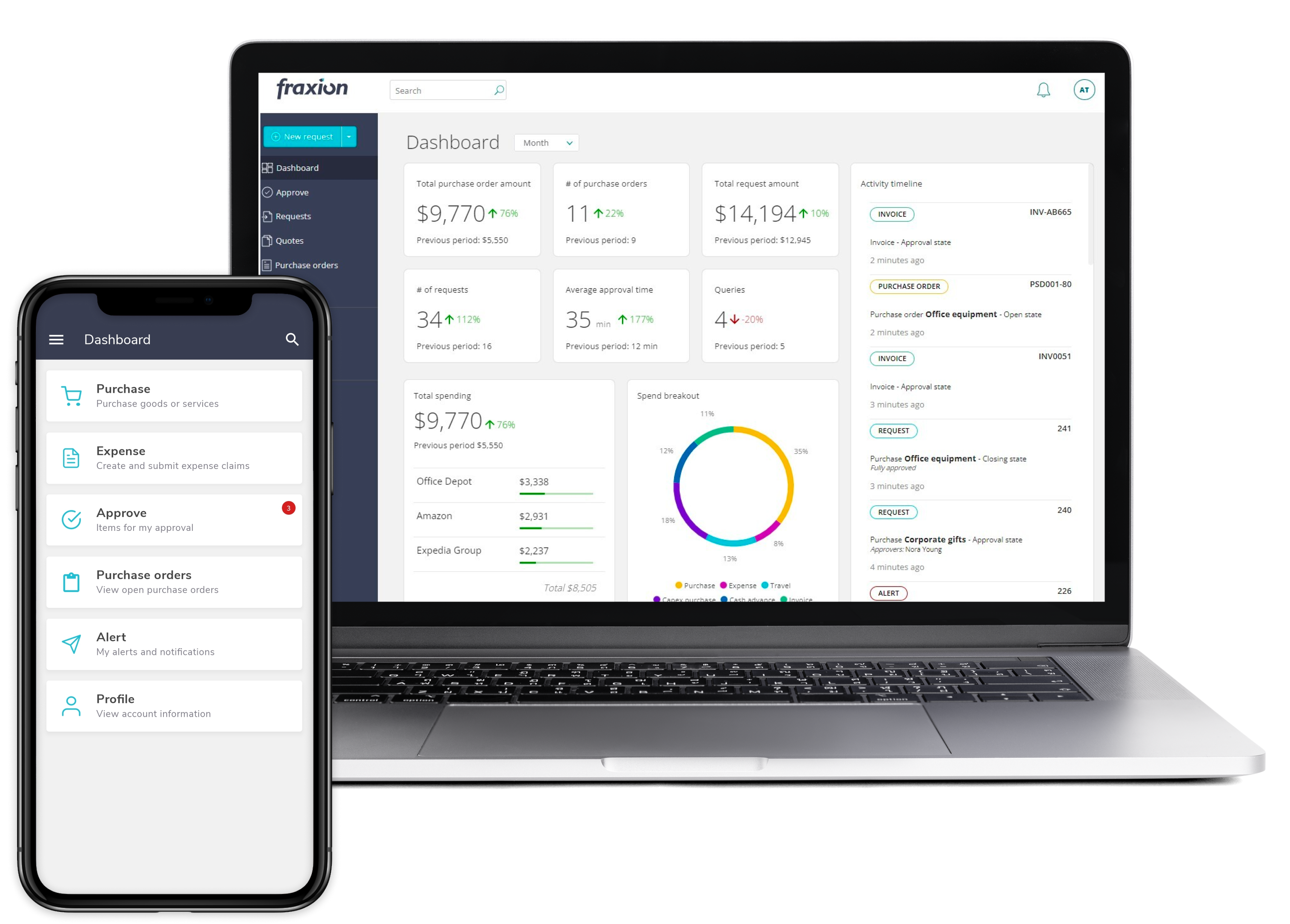

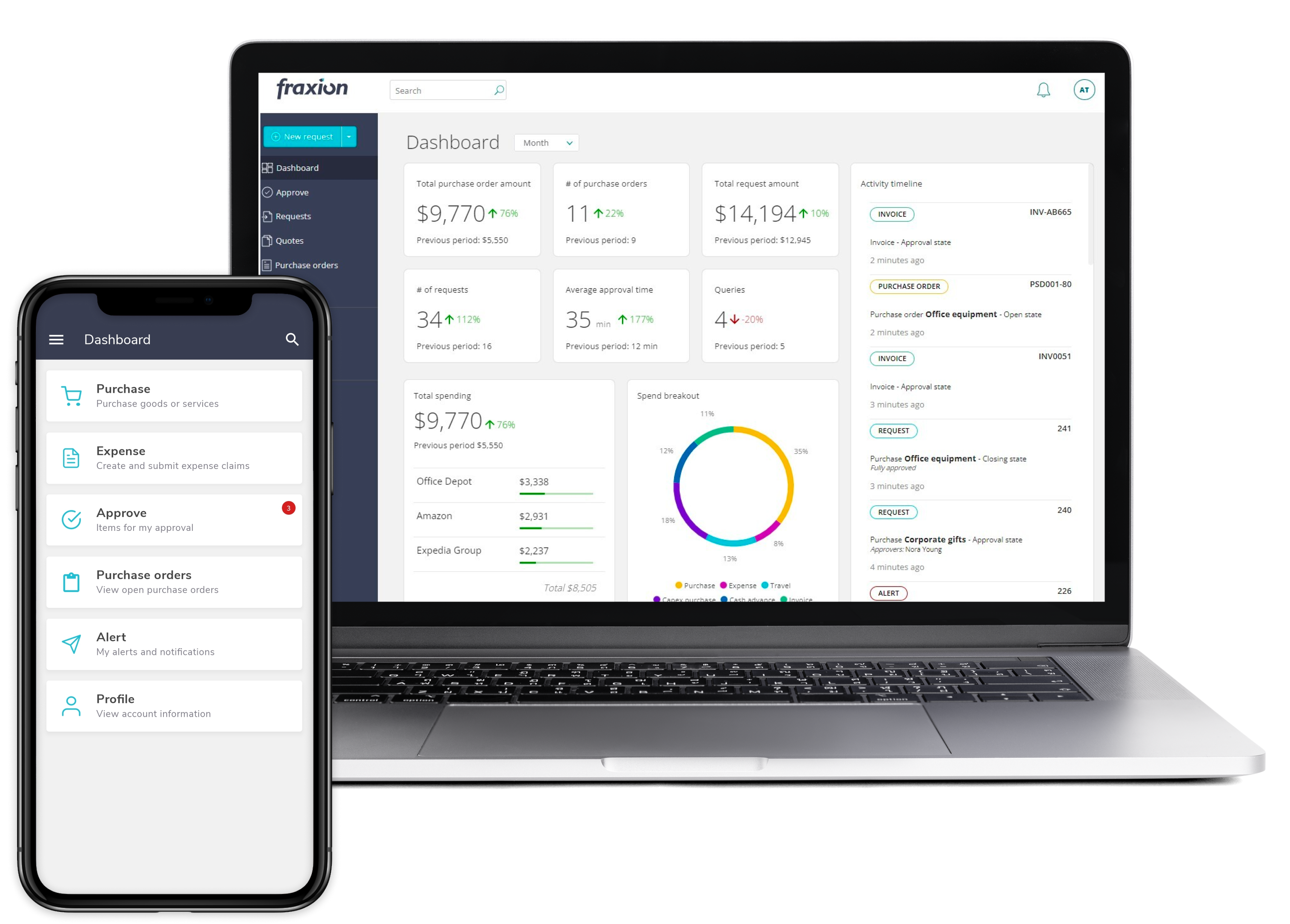

Procure-to-pay suite

Transformed Mukuru's financial processes by seamlessly linking requisitions, purchase orders, invoices, and approvals, optimizing the entire procurement lifecycle. The introduction of decentralized approvals with thresholds and currency preferences enables managers to effectively control spending by country, enhancing financial governance and empowering leaders to make informed decisions across the organization.

Mobile app

An indispensable tool for Mukuru’s Heads of Departments (HODs), especially marketing and sales, enabling them to manage approvals on-the-go without relying on proxies. The app also supports sales agents with timely expense claim submissions, ensuring smooth purchasing and expense processes while keeping pace with their dynamic, fast-moving work in the field.

Expense management

This feature has replaced manual inefficiencies and simplified reimbursement workflows. With automated expense report generation and seamless integration with the finance system, it has significantly reduced administrative burdens, sped up reimbursement turnaround, and saved time across the organization. "It's saving so much time and making things so much easier." Rene Abreu

Travel management

Curbed excessive travel spending and introduced pre-approval processes and booking oversight. As a result, they reduced travel spend by over 50%.

Invoice management

This feature has eliminated the inefficiencies of a manual, email-based process. It allows requesters to upload invoices directly into the system, enabling efficient approval by Heads of Departments and significantly reducing the risk of late approvals, duplicate payments, and reputational issues.

Reporting

Significantly improved reporting capabilities, overcoming limitations of their previous ERP system and enabling accurate reporting across 25 countries. The supplier diversity (ESG) reporting functionality supports industry compliance, while the history tab has empowered teams to independently track transactions and gain real-time financial insights for better decision-making.

Cash advances

Streamlined cash-based financial process, enabling pre-approval of spending and efficient post-trip reconciliation. This reduced risk and spend control. 'We have achieved significant risk reduction through this process." Rene Abreu

SUCCESS STORY

Read Mukuru's complete case study

“We have very complex requirements and need to work with service providers that can workshop solutions and understand our unique requirements to adequately cater to our needs. Fraxion was able to do that.”

Rene Abreu, Group Procurement Manager

Book a custom demo

Get in touch to discuss your organization's requirements, we'll customize a demo to your needs.