Manage business spend with ease

Discover easy, accountable, and automated ways to manage business spend.

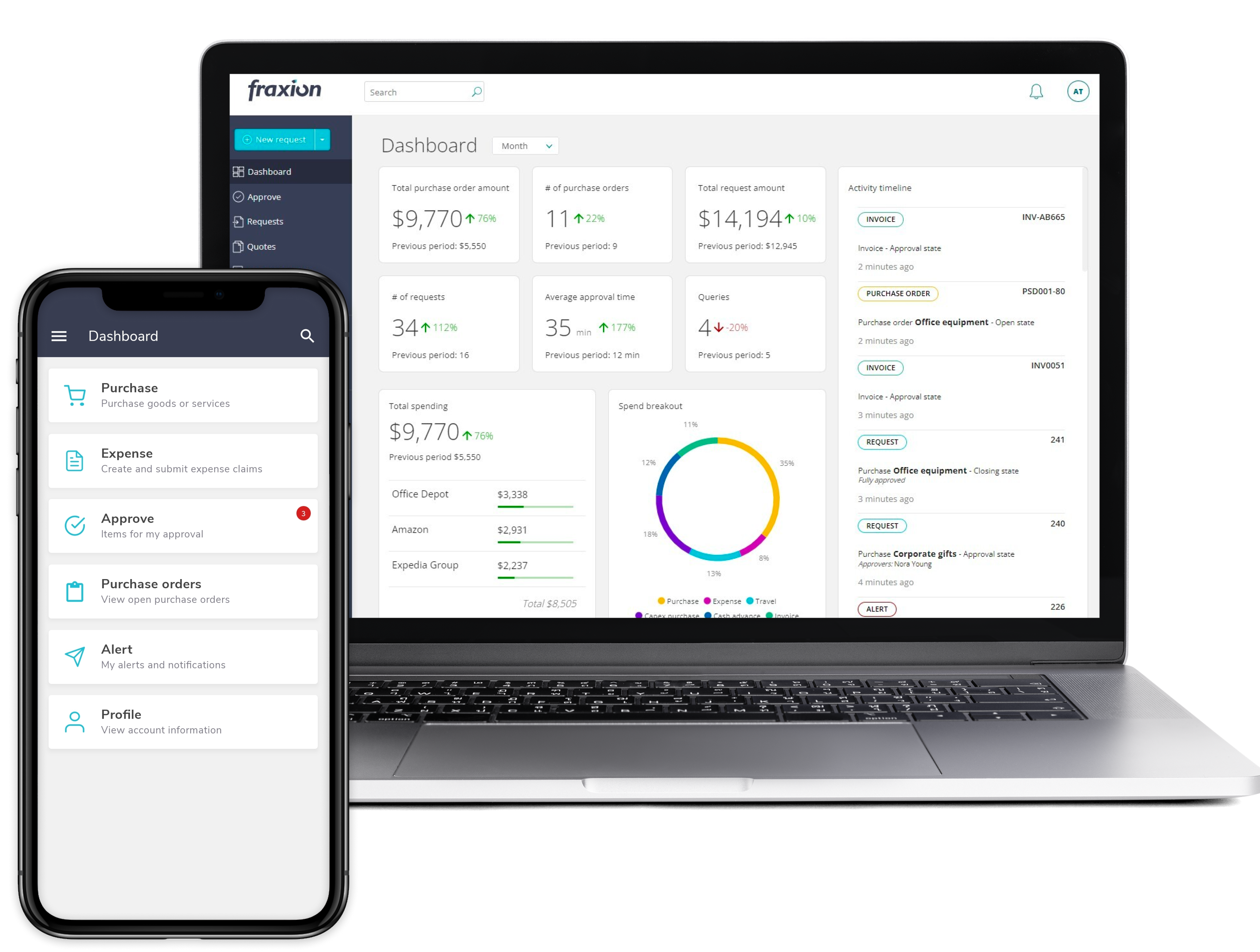

Fraxion’s cloud spend management software guides purchasing behavior and empowers all users to buy, claim, and approve with simplicity, speed, and accountability.

Cloud spend management software effectively manages business spend, increases visibility, saves time and money

Paper-based, manual, and email-based processes are a thing of the past. If you’re still experiencing a lack of visibility into spending, time-consuming processes, inaccuracies, and inefficiencies that lead to delays and penalties, there are easier ways to manage your day-to-day operational spend and reduce costs.

There's no longer a need to manually submit and approve purchases, invoices, and expense requests, or track spend on spreadsheet budgets. By automating these processes with spend management software, not only do you gain complete oversight of multiple touchpoints in the purchasing and accounts payable process, but you can ensure accountability and authorization of all expenditures.

Opting for spend management software such as Fraxion can significantly enhance your ability to oversee and manage business spending. Mobile and integration-ready, it not only facilitates efficiency in spend management but also ensures adherence to budgets and policies. With real-time insights and analytics, Fraxion enables swift decision-making and empowers your organization to identify and achieve measurable savings. Moreover, its swift deployment expedites the realization of returns on your investment in spend management software.

With Fraxion, you can ensure that business spend is always tracked, approved, policy compliant, and on budget!

1. Benefits of cloud solutions

A cloud–based spend management suite delivers the visibility and control to achieve automated efficiency and spend under management in rapid succession, while ensuring business continuity.

Explore these key deployment advantages of cloud-based solutions and how they make it easier for you to manage business spend.

Flexibility

Cloud-based services are scalable; cloud capacity on remote servers can be increased or decreased as your business demands change or grow.

Flexibility

Cloud-based services are scalable; cloud capacity on remote servers can be increased or decreased as your business demands change or grow.

Cloud-based services are scalable; cloud capacity on remote servers can be increased or decreased as your business demands change or grow.

Disaster recovery

Cloud-based solutions provide robust security measures to back up and restore data, making this vital service accessible to every business, regardless of size.

Disaster recovery

Cloud-based solutions provide robust security measures to back up and restore data, making this vital service accessible to every business, regardless of size.

Cloud-based solutions provide robust security measures to back up and restore data, making this vital service accessible to every business, regardless of size.

Automatic software update

No on-site servers required; Fraxion is responsible for the maintenance, regular software updates and security measures. Our spend management software is actively monitored for vulnerabilities and undergoes active threat assessment and...

Automatic software update

No on-site servers required; Fraxion is responsible for the maintenance, regular software updates and security measures. Our spend management software is actively monitored for vulnerabilities and undergoes active threat assessment and...

No on-site servers required; Fraxion is responsible for the maintenance, regular software updates and security measures. Our spend management software is actively monitored for vulnerabilities and undergoes active threat assessment and management.

Capital expenditure free

Cloud computing eradicates expensive hardware and database management software requirements.

Capital expenditure free

Cloud computing eradicates expensive hardware and database management software requirements.

Cloud computing eradicates expensive hardware and database management software requirements.

Broad user adoption

IT resource and project management demands are minimal. A user-friendly, mobile system accelerates user adoption.

Broad user adoption

IT resource and project management demands are minimal. A user-friendly, mobile system accelerates user adoption.

IT resource and project management demands are minimal. A user-friendly, mobile system accelerates user adoption.

Mobile productivity

Cloud-based solutions give you the freedom to work from any location. Remote access and mobile device flexibility drive productivity, reduce process delays, and ensure business continuity.

Mobile productivity

Cloud-based solutions give you the freedom to work from any location. Remote access and mobile device flexibility drive productivity, reduce process delays, and ensure business continuity.

Cloud-based solutions give you the freedom to work from any location. Remote access and mobile device flexibility drive productivity, reduce process delays, and ensure business continuity.

Security

Cloud computing protects sensitive data and manages risk; all data is stored in the cloud and will not be lost through the damage or loss of a laptop or mobile device. Fraxion data is hosted in secure, compliant locations with security...

Security

Cloud computing protects sensitive data and manages risk; all data is stored in the cloud and will not be lost through the damage or loss of a laptop or mobile device. Fraxion data is hosted in secure, compliant locations with security...

Cloud computing protects sensitive data and manages risk; all data is stored in the cloud and will not be lost through the damage or loss of a laptop or mobile device. Fraxion data is hosted in secure, compliant locations with security certifications and robust authentication processes.

Competitive edge

By moving to the cloud, you will gain enterprise-level technology, regardless of the size of your business.

Competitive edge

By moving to the cloud, you will gain enterprise-level technology, regardless of the size of your business.

By moving to the cloud, you will gain enterprise-level technology, regardless of the size of your business.

Complements ERP solutions

Fraxion's spend management system can integrate with existing on-premise or cloud-based ERPs and accounting systems.

Complements ERP solutions

Fraxion's spend management system can integrate with existing on-premise or cloud-based ERPs and accounting systems.

Fraxion's spend management system can integrate with existing on-premise or cloud-based ERPs and accounting systems.

See Fraxion's spend management software in action

2. How spend management software drives efficiency, adoption, and a quick ROI

Rapid deployment, time-to-value, and an easy user experience

To effectively manage business spend, you need to replace existing inefficient processes with a solution that your team wants to use. This user adoption is achieved through:

- Ease of use

- Accessibility

- Speed

- And getting tasks done with less friction

Fraxion’s interface is designed with user experience in mind, aimed at simplifying requisition-to-PO, expense, accounts payable, and approval processes. This intuitive simplicity extends to the edge of the organization, ensuring that all users are empowered to purchase and spend responsibly.

Purchasing managers and buyers gain efficiency, visibility, and control over purchasing and supplier approval processes.

IT managers can rest assured that data is secure and robust authentication and security certifications are in place.

Financial departments and leaders gain the required control they need to maintain compliance, manage, and report on spend against budgets, to ensure adequate cash flow and protect working capital.

Fraxion enables users to easily create their requisitions using the web or mobile app, wherever they are. The spend management software requires minimal end-user training and all users have access to a Support Site with handy tips, user guides, video tutorials, and release notes.

Fraxion guides users with the following capabilities:

- Administrators can easily setup and configure companies, departments, users, approval levels, and other preferences.

- Tool tips help guide users through processes.

- The interface will only display information based on the security level given to a particular user and the functionality relevant to their profile.

- Mobile, in-app, and email notifications let users know when action is required.

- Alerts flag non-compliance and potential risks in transactions

Role-based access allows designated users the right to view and compare budgets to actual spending. Fraxion’s seamless integrations with your ERP limit general user access to your accounting system while still maintaining accurate financial records, and trimming the cost and time required for spend management to reach ROI.

Save time and reduce errors by going digital to manage business spend

Manual processes take up valuable time and are prone to errors. Fraxion’s spend management software automates repetitive, time-intensive, purchasing and accounts payable processes.

Common manual requisition and approval inefficiencies you can avoid when managing business spend

1. Somebody requests a purchase or submits an expense claim and emails it to their approver.

2. That approver, then, would either send it back for more information, approve the request blindly with no budget visibility, or pass it on to the next approver.

3. Unexpected delays inevitably come up. The next approver happens to be on vacation, overlooks emails in the catch-up process on their return, while the requester or purchasing manager wastes time trying to find the source of the bottleneck with no visibility into the process.

4. Operations are impacted when goods or services aren’t approved in time and reimbursement delays cause frustration and employee dissatisfaction.

Fraxion’s spend management software removes all of these speed bumps. You have the ability to set up specialized routing rules to ensure the right people are notified instead of the request getting lost in a sea of papers or email threads. Approver out of the office? Set up proxy approvals and out of office delegation for alternate review when standard approvers are unavailable. Or, approve and take action on requisitions directly from your email, or mobile app from anywhere in the world, while checking the impact of that spend against the appropriate budget before approval. Lost documentation becomes a thing of the past. Upload receipts and quotes and centralize purchase orders, invoices, and goods received notes for improved process efficiency and auditability.

Automate workflows and enable internal collaboration

Streamline how you manage business spend with automated multi-level approval workflows. Improve the process by attaching documents directly to the requisition for verification purposes and setting up automated emails, mobile and in-app alerts to notify approvers when review is required.

Approvals can be actioned on any device, from any location. This automated efficiency connects your teams, keeps relevant users up to speed and enables efficient collaboration throughout the lifecycle of a requisition.

Not to mention, this collaboration aligns your entire organization. Fraxion makes it easy for finance to track the status of a request with detailed audit trails of each touchpoint and action with date and time stamps and detailed, customized reporting. Meanwhile, Purchasing managers no longer have to spend hours chasing down requisitions, trying to figure out what an approval was for, or determining how far along a requisition is in the process. Now, when a status update is requested, users and purchasing managers alike have all the necessary information at their fingertips.

2. How spend management software drives efficiency, adoption, and a quick ROI

These spend management software features facilitate everyday processes and make it easy to manage business spend.

Purchase requisition-to-PO

Ensure that all purchase requisitions are tracked and submitted via a web or mobile form. The process is easy, on demand, and enables document uploads to verify purchases. Supplier selection processes ensure that users choose approved suppliers or submit a new supplier to the purchasing manager for approval, within the system.

Once a purchase request is submitted, Fraxion’s advanced routing engine does the heavy lifting. It ensures that requests get to the right approvers via automated approval workflows, from simple structures to custom multi-level and escalating approvals set up according to your delegation of authority.

To strengthen how you manage business spend, Fraxion’s internal control framework ensures policy compliance. At decision points, the impact of each purchase request can be reviewed against the appropriate budget, prior to committing to spend.

Purchase orders (POs) are automatically generated, once approval has taken place in the system, reducing the risk of unauthorized spend and non-PO purchasing. Automated POs can be emailed directly from the system, while any revisions to POs can also be submitted and routed for approval.

Expenses

Capture expenses as they happen via the mobile app. Snapshot and attach receipts and submit for approval. Easy mobile approvals ensure that timely reimbursements take place.

Travel

Streamline local and international travel processes and ensure pre-approval and policy compliance: from request creation to the processing of invoices, the generation of travel itineraries and acknowledgement of travel expenses incurred.

PunchOut

Shop from an approved supplier’s online catalog (e.g. Amazon Business, Staples, Grainger, etc.) from within Fraxion’s interface. Enjoy an easy and familiar online shopping experience that provides integrated access to millions of products, while leveraging requisition and approval workflows in Fraxion.

Internal catalogs

Set up and maintain internal supplier catalogs to shop and review product details with ease. Set up carts and price lists. Simplify purchasing from approved suppliers with repeat purchases and fixed ordering. And take advantage of requests that are routed for approval.

AP automation

Streamline invoice intake and leverage AI-powered data extraction and review to capture line-item level invoice data and verify accuracy.

Invoice approval and matching

Streamline the accounts payable workflow and manage risk with invoice approval, variance alerts, receiving and electronic 2 or 3-way matching capabilities. These steps eliminate overpayments and the risk of duplicate invoices.

Spend analytics and reporting power

Fraxion’s spend management software offers a business intelligence (BI) platform with embedded spend analytics and reporting power. You can gain more visibility and actionable insights. Measure processing costs and report on spend by:

- Company

- Supplier

- Budget

- Transaction

- Employee

- Alerts

This granularity empowers finance leaders to make data-driven decisions and effectively manage business spend by identifying cost saving opportunities to reduce the right costs.

Increased spend visibility drives accountability

An effective finance team needs to make sure all spending data is collected, every budget is maintained, and reports are accurate.

Spend visibility

You can’t manage what you can’t see, Fraxion’s spend management software gives you complete visibility of spending activities with the business intelligence to analyze and report on it to make better informed decisions.

Accountability

With Fraxion’s automatic audit trails and supporting documents centralized and easy to find, all the information needed to successfully manage business spend organization-wide is readily available. Any transaction that the finance department might need is a quick search away with multiple search and filtering criteria.

You can maintain accountability throughout the entire requisition process: who requested, who approved, who received, and who approved the invoice. Every change to the requisition is tracked within the system, leaving a detailed audit trail to trace events back to individual users.

Auditability

This accessibility and oversight further streamlines the auditing process, ensuring quick access to information and documentation if a query arises, and improving transparency and auditability overall.

Save money and reduce rogue spending

Now that you have real-time insight into budgets at decision points and oversight of spending patterns by user, supplier, or department, you can put a stop to overspending.

Use Fraxion’s budget control capabilities to view the details of pending, committed, and actuals broken down by budget period and cost center allocation / GL account or project.

With these capabilities you’re equipped to eliminate overspending and on-track to effectively manage business spend.

With Fraxion’s spend management software in place, your company will gain full visibility into purchasing and accounts payable. Over time, this will translate into significant cost savings for several reasons:

- With full visibility into the purchasing and accounts payable process, it’s much easier to identify fraudulent spending. Additionally, employees will think twice—or even three times—before trying to purchase goods or services without approval.

- Rogue spending occurs when an employee buys something without going through the proper authorization channels, which can result in forcing your organization to absorb unnecessary expenses. With Fraxion’s spend management software, your organization can end rogue spending.

- Gaining insight into your organization's spend does more than just track what employees buy, it also lets you audit spending by department, supplier, or other criteria. This helps you zero in on where to make improvements and determine whether or not you're getting the best deals and taking advantage of every available discount.

3. Spend management software that ensures compliance

With Sarbanes-Oxley (SOX) legislation, business leaders are required to keep track of all financial statements. Fraxion’s financial controls and spend oversight aids organizations in becoming SOX compliant with regards to procurement, by empowering management to establish and maintain internal purchasing controls, and mitigate the risk of fraud.

Fraxion helps manage business spend by tracking each requisition from initial creation through to approval, purchase order generation, receiving, invoice matching and invoice approval.

Internal controls in Fraxion provide preventive and detective controls. These accounting best practices include the mechanisms, rules, and procedures put in place to promote accountability, and prevent fraud.

Preventive controls prevent errors and fraud and reduce the need for reactive or corrective action after-the-fact. These include approval processes, policy enforcement and budget control measures.

Detective controls detect issues and provide evidence of errors or losses, these include monthly reconciliations of organizational transactions, budget-to-actual reporting, and audit trails.

- All purchase and expense requests and invoices are automatically captured in the database and available for audit.

- Purchase justifications and information requests made by approvers are captured in each transaction.

- Supplier take-on is controlled by Fraxion; new suppliers are subject to management approval.

- Detailed audit trails provide valuable insight into all procurement and expense authorizations.

- System rules, configured policies, approval structures and delegation of authority prevent unauthorized expenditures.

Fraxion's spend management software provides transparency and proactive control of purchasing and accounts payable, ensuring that spending is approved before the costs are incurred.

Book a customized demo

Get in touch to discuss your business spend management needs.